Industry Overview

Digital finance is a key driver of the digital economy, supporting transformation, enhancing services, and bridging digital and real-world industries. The rapid evolution of digital technologies is injecting abundant momentum into the continuous development of the digital economy. Rapid advances in technology continue to fuel this growth. As large AI models evolve, their ability to process and analyze complex text and images improves, enabling powerful dialogue and content generation. These capabilities help to automate routine financial tasks. Today, the "AI+" model is being adopted across banking, insurance, and securities, pushing finance into a smarter, more digital future.

Challenges

Poor Customer Experience

Conventional customer services rely heavily on manual work and outdated knowledge bases, making it hard to deliver quick answers to complex questions, and leading to lower customer satisfaction.

Outdated Risk Control Methods

Conventional loan approval depends on manual review and expert judgment, leading to high workloads and low efficiency.

Inaccurate Marketing

Conventional marketing approaches lack personalization, leading to low customer conversion rates.

Solutions

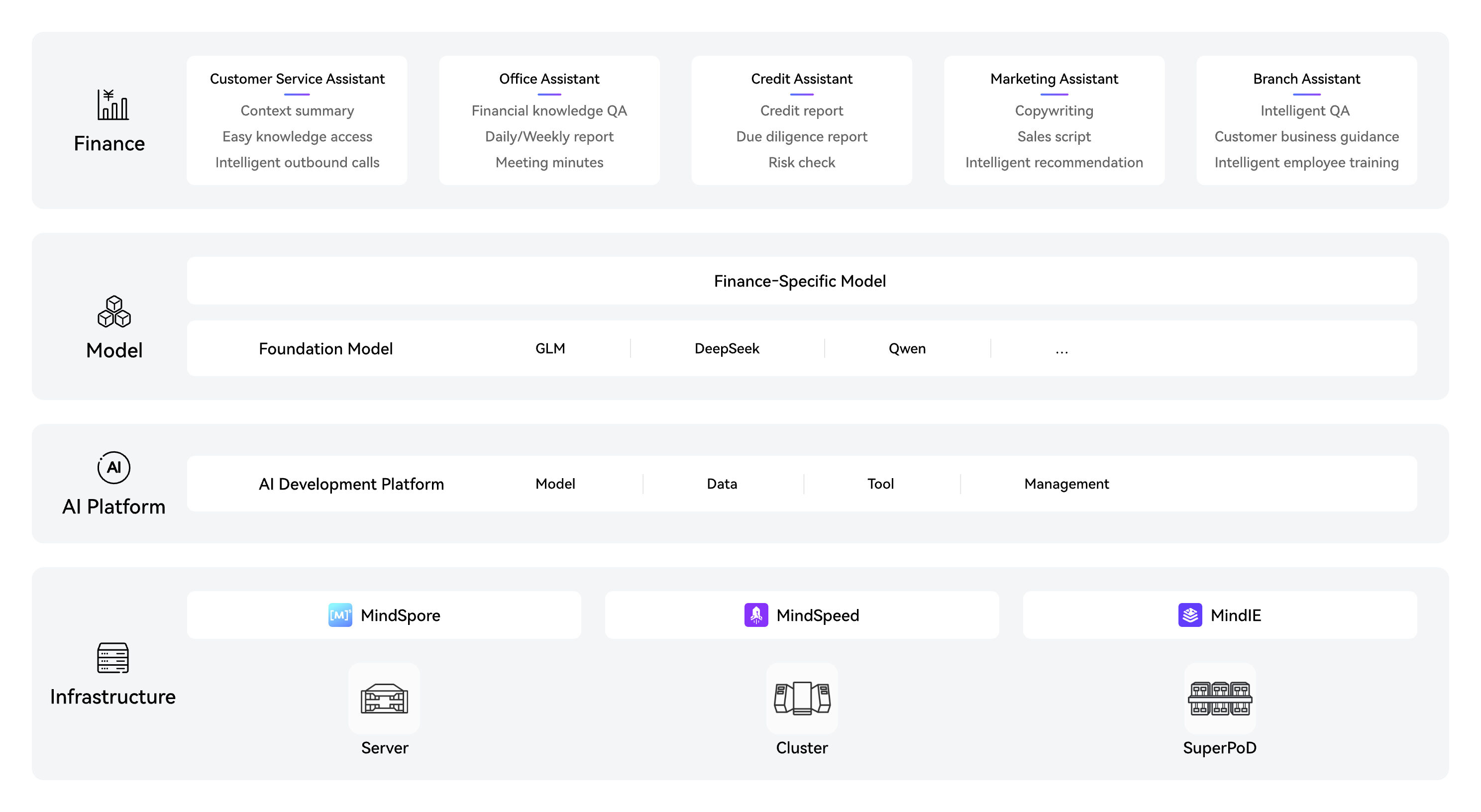

Related Products

Application Scenarios

Customer Service Assistant

When a customer calls or texts, a foundation model analyzes their voice and message to detect emotion and intent, offering script suggestions for the staff. It also searches the knowledge base for answers to customer questions. After the conversation, a service ticket is created automatically.

Credit Assistant

A foundation model supports the full loan process. Before application, it analyzes data to help create credit reports. During application, it assesses credit history and repayment ability to generate due diligence reports. After approval, it aids in risk checks and post-loan analysis.

Marketing Assistant

Quickly generates personalized copy to accelerate marketing content creation and tailors product recommendations—such as wealth management and credit card installments—based on customer profiles, helping increase conversion rates.